A lack of capital is the number one reason why startups fail. A study by tech market intelligence platform CB Insights found that among 110+ post-mortem startups, 38% didn’t make it because they “ran out of cash/failed to raise new capital.” Simply put, your ability to raise money, especially in the critical early stages of your business, directly correlates to your odds of success.

When you’re bootstrapping a startup without any capital coming from external sources, it’s all hands on deck, and you often need to think outside the box to come up with bootstrap funding. And that’s exactly what we’re going to cover in this post.

Here are some of the most potent alternative capital raising strategies for bootstrapping a business, along with real-life examples of companies that have succeeded using them.

Partner with a Co-Founder

Our first technique is simple but isn’t necessarily on the radar of all startups: Find an elite entrepreneur who brings a ton of value to the table and partner with them. Data clearly shows that companies with two founders are statistically more likely to succeed than those with just one and raise 30% more capital.

Data clearly shows that companies with two founders are statistically more likely to succeed than those with just one and raise 30% more capital. Click To Tweet“In my own experience it has been nearly universal that startups do better when they have two balanced and fully invested partners,” explains Thomas Koulopouos, founder of business consulting brand Delphi Group. “The ability to rely on each other to share the burden, temper risks, collaborate creatively, take on specific areas of responsibility, and to motivate each other are all absolutely critical during the early stages of growth.”

Besides the expertise and additional skill set a co-founder brings, this also gives you access to far more resources like their personal income, savings, and borrowed money from friends and family, as well as potentially priceless industry connections. Rather than relying solely on your own resources, partnering with a co-founder allows you to double them. Not to mention, a partner’s strengths can often balance out your weaknesses to create a more well-rounded business that’s poised to succeed.

An Example of Co-Founding Success

There are countless companies that were built with two rock solid co-founders. Steve Jobs and Steve Wozniak starting Apple and Larry Page and Sergey Brin launching Google are two of the most notable partnerships.

But another great story is Linda Avey and Anne Wojcicki creating the direct-to-consumer DNA testing product 23andMe. Avey’s desire to design a large-scale genetics database to facilitate medical breakthroughs and Wojcicki’s background as a biotech analyst at a hedge fund made them the perfect complement for one another.

Have Customers Make Partial Payments Upfront

Let me start off by saying this won’t be a viable strategy for all bootstrapped startups. If you’re just getting your business off the ground and have zero clout, for example, it’s probably not realistic to expect customers to give you partial payment upfront. That said, it can definitely work in many situations and has the potential to be a highly effective way to fill orders and give your startup some much needed momentum with minimal bootstrap capital.

The concept of partial payment is pretty straightforward. You negotiate the terms prior to making a sale where you require a customer to pay a specified portion of the money (typically between 25-50%) for their order upfront. Once the order has been completed, they then pay the rest of the money. That way, you should be able to cover most, if not the entire cost of filling the order without having to tap into any external sources.

As long as you deliver and your customers are satisfied with their purchases, you can quickly grow your customer base and establish valuable brand equity. As a result, this can be an excellent way to improve your cash flow without racking up unnecessary out-of-pocket expenses.

The key to succeeding is ensuring you have a fully fleshed out product beforehand and generating enough buzz to get customers interested enough to make a partial payment upfront. If you can do that, you should be in a position to negotiate these terms.

An Example of Partial Payment Upfront

This concept is more common than you may think. In fact, this was the exact model Dell Computers used to ignite massive growth back in the ‘80s. During the early stages of launching his company, owner Michael Dell was continually running out of cash when trying to pay for more inventory. So once he had established a base level of trust with his customers, he nurtured those relationships and asked them to pay in advance before getting their computer.

“Dell then had his customers’ cash to buy the supplies needed to build the computers they ordered,” writes entrepreneurial thought leader John Mullins. “By getting his customers to pay in advance, Dell completely changed his company’s cash flow, and spurred their ability to scale rapidly.” And as we all know, it worked out quite well for him.

Use Debtor Finance

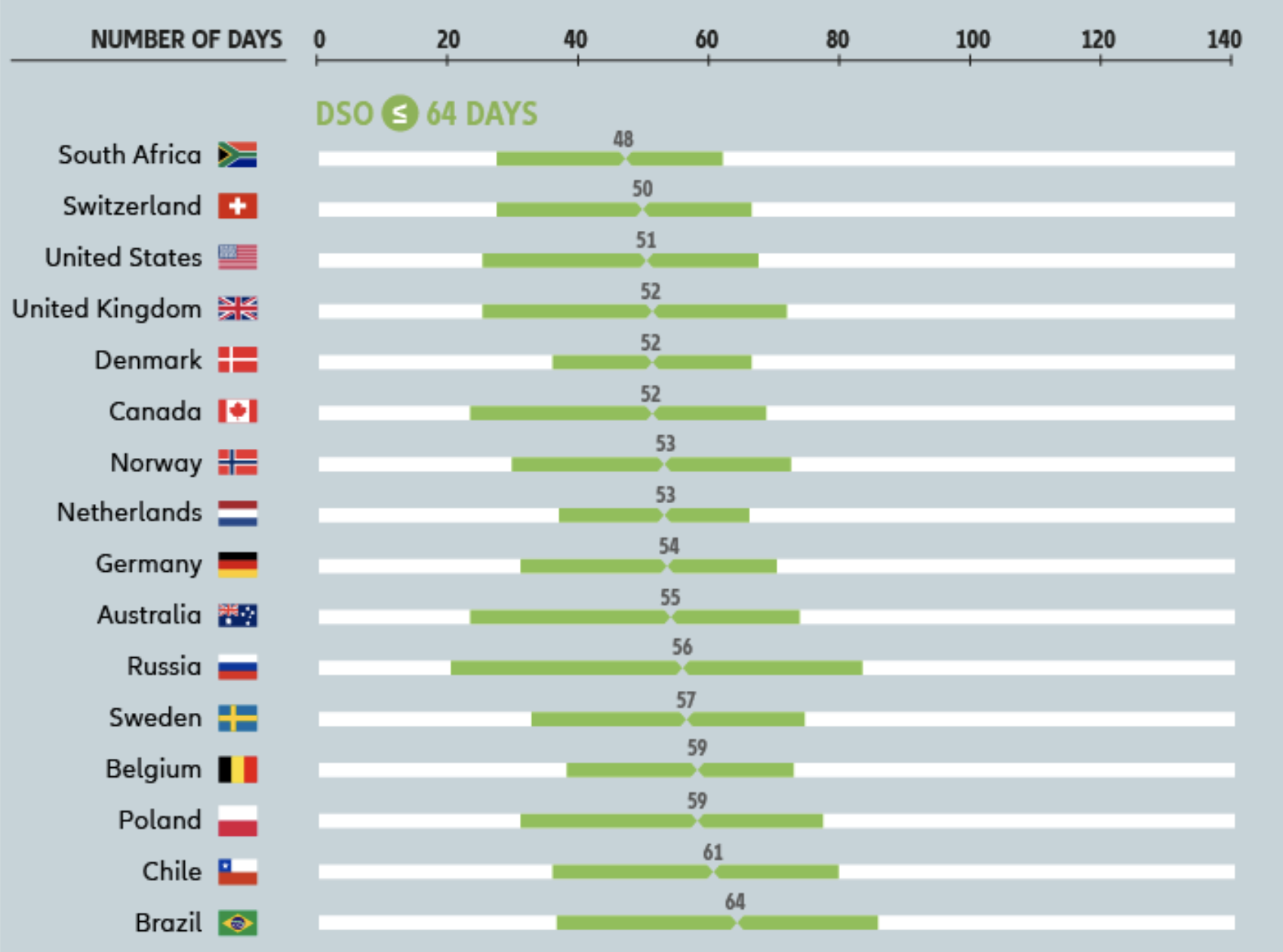

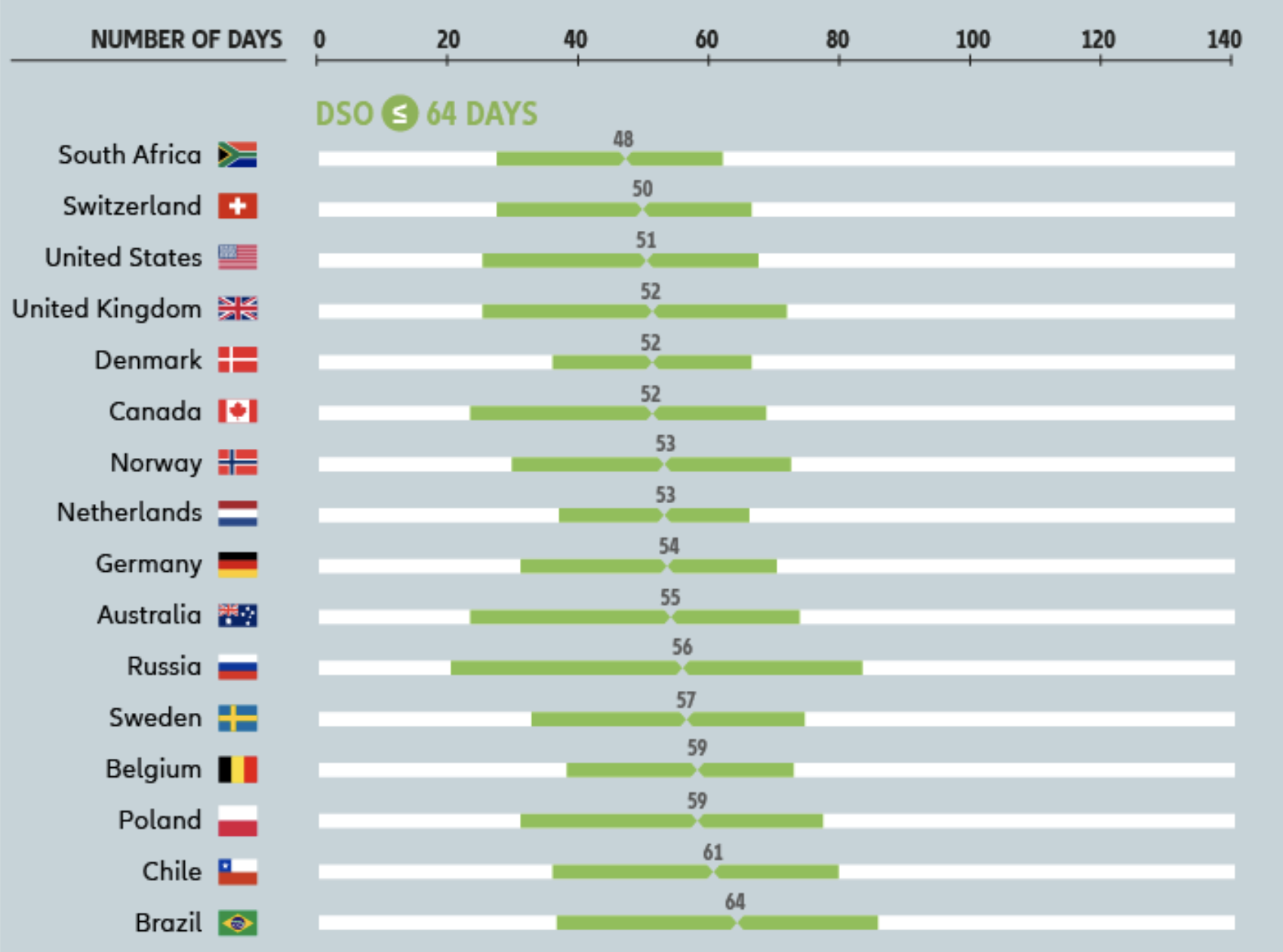

One of the biggest obstacles that gets in the way for new startups is simply getting paid on time. In the US, the average Days Sales Outstanding (DSO) is 51. However, it’s considerably longer than that for many other countries in the world, with the global DSO hovering around 64.

In other words, it takes, on average, over two months for businesses to receive payment after they send an invoice. As you might imagine, this can be a major problem for startups that are still trying to get the ball rolling and can be a serious growth inhibitor. After all, without a consistent supply of capital coming in, you may struggle to purchase new inventory, buy key equipment, pay employees, and so on.

If this is an issue you’ve faced, debtor finance is one of the key alternative capital raising strategies to consider. Also known as invoice finance or debt factoring, this is where you receive a line of credit that’s linked to your outstanding invoices. Rather than waiting the full duration to get paid by a client (which as we just mentioned often takes around two months), debtor finance gives you an advance on the money so you can keep capital pumping in and avoid cash flow gaps.

The exact rates will vary, but you can generally expect to get around 95% of the value of your total invoice upfront, then you receive the remaining 5% once the invoice is paid in full, less any fees. In terms of how long it takes to receive payment, it’s usually within 24 hours. This form of bootstrap capital doesn’t involve tapping into any external resources like you would with venture capital, but instead leverages the money owed to you much quicker than you would normally get it.

While it’s not feasible if you’re a brand new startup without any outstanding invoices, it can work extremely well if you’re owed money but need access to it much quicker than what would normally be possible. To learn more about debtor finance and get recommendations for the top companies of 2021, check out this resource from Investopedia.

An Example of Debtor Finance Success

Azura Runway is a “global supplier for luxury fashion, connecting brands with consumers at affordable prices.” Launched in 2019, their business took off quickly, which was a good thing. However, they had difficulty keeping up with customer demand because of slow invoice payments.

But after using debtor finance, they were able to generate instant capital that allowed them to expand to digital marketplaces like eBay, Catch, and Lazada. This, in turn, created major growth and relieved much of their financial pressure.

Tapping Into the Right Alternative Capital Raising Strategies

As we’ve just learned, there are a number of ways to go about bootstrapping a startup. And it by no means has to involve the traditional routes of maxing out your credit cards or burning through your savings. Leveraging smart alternative capital raising strategies like these can help generate the bootstrap capital needed at different stages of growth.

Besides the money it brings in short-term, bootstrapping shows potential investors that you’re serious about making your company a success, which can work to your advantage later on because it shows you’re less of a risk.

If you’re looking for a partner to unlock next-level growth and create a culture of continuous learning and improvement, reach out to Grwth today.